On this day 26 years ago, the UK Charity Commission rejected Scientology’s application for charity status, concluding it “does not benefit the public.” The ruling dealt a major blow for Scientology in their efforts to claim legitimacy through government recognition and juxtaposed their success with gaining IRS tax exemption in the United States 8 years prior.

But how has the ruling impacted Scientology’s UK operations in the nearly three decades since?

Firstly, it’s important to note that the entity applying for charity status was not the Church’s main UK arm. Since 1977, Scientology has been operating in the United Kingdom through an Australian-registered charity under the name ‘Church of Scientology Religious Education College, Inc.’ (COSRECI). Filings with the Australian Charities & Not-for-Profits Commission (ACNC) list COSRECI as an ‘overseas entity’ which does business exclusively in the UK, allowing the organisation to escape scrutiny and utilise a loophole in tax law.

In 2010, an investigation by the Australian Channel7 ‘Today Tonight’ journalist Bryan Seymour revealed that COSRECI’s registered head office was in fact a suburban home on the outskirts of Adelaide, owned by a local farmer who had no knowledge that his address being used in Scientology’s incorporation documents. At the time, a spokesperson told The Advertiser “It is, of course, not the headquarters, but is merely to receive mail and clearly an error as the Public Officer moved from this address.”

Unlike in the United States, where Scientology Orgs operate as independent legal entities under the corporate umbrella of the Church of Scientology International (CSI), COSRECI accounts for the entirety of Scientology’s affairs in the United Kingdom. Saint Hill, London, Birmingham, Manchester, Plymouth, Sunderland and Brighton are all registered as business addresses with Companies House. It also appears that COSRECI – at least on paper – operates separately from CSI and stands alone as its own legal entity, though its incorporation documents refer to “the Mother church” as having “ecclesiastical” influence over the organisation. This corporate structure creates a complex web that provides Scientology with an element of legal protection and obfuscates their financial transactions, such as international transfers of large sums of wealth between related parties.

However in order to protect their UK operations from government scrutiny, a new non-profit company was registered with Companies House in 1995 under the name Church of Scientology (England and Wales), and its incorporation documents suggest it was established specifically for the purpose of seeking charity status. This entity continues to exist to this day, though accounts filed in October 2025 show it has no employees and assets of just £20 – a number that has not changed in 20 years.

In order to register as a charity in the United Kingdom, an organisation must pass a public benefit test. Applications are reviewed by the Charity Commission, which scrutinises:

Charity Commission Public Benefit: Overview

- what the charity is set up to achieve – this is known as the charity’s ‘purpose’

- how the charity’s purpose is beneficial – this is the ‘benefit aspect’ of public benefit

- how the charity’s purpose benefits the public or a sufficient section of the public – this is the

‘public aspect’ of public benefit- how the trustees will carry out the charity’s purpose for the public benefit – this is what is known

as ‘furthering’ the charity’s purpose for the public benefit

According to charity law, religious organisations benefit from a presumption of public benefit however the Commissioners decided that in the case of Scientology, “the relative newness of Scientology and the judicial and public concerns which had been expressed about its beliefs and practices, led them to conclude that it should not be entitled to the presumption of public benefit. Accordingly, it was for CoS to demonstrate that it was established for the public benefit.” In short, they were unable to do so.

The Charity Commission launched a wide-ranging and detailed analysis into Scientology’s core practices, examining the intricacies of auditing and training and ultimately concluded that “the private conduct and nature of these practices together with their general lack of accessibility meant that the benefits were of a personal as opposed to a public nature.”

Scientology subsequently lost its bid for charity status in the UK, however in the years since it has continued in its efforts to gain legal recognition and tax benefits. In 2013, a Supreme Court case determined that Scientology chapels (a single room in which events are held in an Org) were “places of worship” for the purposes of wedding ceremonies and the church subsequently launched a ten-year legal battle against HMRC to secure tax exemption as a result. That resulted in a Specialist Valuations Tribunal ruling Scientology’s buildings are “places of public worship” and are therefore exempt from paying Business Rates.

However despite being registered as a non-profit in Australia, COSRECI remains liable for Corporation Tax on its profits in the UK. As a result, the organisation borrows vast sums of money from it’s US counterparts such as CSI, Celebrity Centre International and Flag, their Florida headquarters, in order to offset their annual profits to minimise their tax bill. Scientology’s most recent accounts, filed with the ACNC in September 2025, show a turnover of $36 million AUD and debts owed to “related parties” in excess of $133 million AUD.

In 2023, the Charity Commission confirmed “The Commission’s decision in 1999 to refuse to register the Church of Scientology cannot now be appealed.” This means that should Scientology wish to seek charity status again, they would need to submit a new application and once again undergo an extensive process of scrutiny, this time requiring them to evidence how their core practice of auditing has changed so as to provide a public benefit.

So where does that leave us today? Scientology’s status in the United Kingdom is somewhat complex. In the 1970s, a government inquiry (the Foster Report) found the practice of Scientology amounted to psychotherapy and recommended it should therefore be regulated. In 1984, High Court Judge Lord Justice Latey ruled that the organisation is “dangerous”, “harmful” and “out to capture people, especially children and impressionable young people.” The Charity Commission’s view is that Scientology “does not benefit the public”, however its buildings are designated places of public worship and therefore benefit from an exemption from paying local authorities Business Rates.

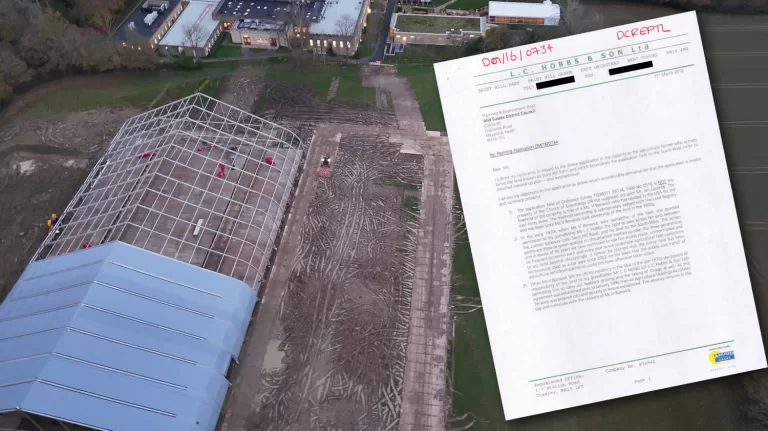

But 26 years after failing to obtain charity status, Scientology remains liable for tax on its UK profits – something it avoids through it’s complex corporate structure, intra-company loans and overseas registration. In 2024, COSRECI paid just £1,840 in Corporation Tax and earlier this year, Mid-Sussex District Council reported the organisation cost the taxpayer £84,000 after it applied – and subsequently withdrew – an application for a protest ban to be implemented outside their headquarters near East Grinstead. Not only does Scientology provide no public benefit, its efforts to suppress critics and former members comes at a cost to the public purse and it continues to operate free from government scrutiny.

Here is the Charity Commission’s 1999 ruling in its entirety:

That's a pound for every person who typed "Scientology" into the 2021 census form…

And doesn’t even make a dent in the cost they have incurred to the local taxpayer with the PSPO, Highways inspections and planning enforcement… It’s disgusting.

I believe the Charity Commissioners also refused Scientology charitable status on the grounds that its services were not freely available to the public it was supposed to serve, as required by law.

If you go to a church, you can put some money in the plate as it comes around… or not. You are still welcome to attend and participate. Scientology is a pay-to-play mystery cult, with 'fixed donations' (aka a price) for everything, so it can never clear that hurdle.

Correct. Which just makes it worse imo. Not only does it serve no public benefit, but it costs money! Yes, they may donate £50k to local charities but that’s nothing compared to the amount they raise at the IAS event alone.

I did a livestream with Marc Headley recently, who worked at the IAS event while he was posted in Gold. He said they’d quite easily spend $1 million on production because they raise “tens of millions” of dollars on the night.

And all of that money somehow leaves the country, too.

Not before they spend a huge chunk of it on Fair Gaming me, though!

Someone is doing some fancy footwork, or flat out lying, claiming COSRECI is seperate from $cientology. According to the once secret 1993 Closing Agreement between $cientology and the IRS, COSRECI is listed as a $cientology entity, along with CSI, RTC, CST, and a bunch of other $cientology organizations:

There is no doubt it is a Scientology entity and COSRECI’s accounts list CSI, Flag and CC Int (to name a few) as “related parties” .. But unlike Orgs in the US, which are direct subsidiaries of CSI, COSRECI is technically independent. It’s Incorporation document describes CSI as exercising “ecclesiastical authority” over it. This arguably creates a legal separation between the two entities, I suspect as a tactical strategy to protect “the Mother Church” should COSRECI find itself in legal trouble.

The IRS doesn't care about "eccliesiastical authority". In the Closing Agreement anything listed as a "$cientology-related Entity" is under the financial control of $cientology, and $cientology has to account for the money and assests of that organization, as well as any unlisted entities with assests or receipts of $15 million, or more that it might control. COSRECI is listed, so it's under the direct financial control of $cientology.

Agreed.

The problem arises when you look at UK Company Law. CSI (and indeed David Miscavige) exert total control over COSRECI, and yet neither is listed on Companies House as an entity/person with significant control…

Sounds like something that needs to be addressed.

100%!

Very nice summary of facts. Very useful outside the UK especially when the cult brags about being recognized in the UK. Something like this ought to be done for every country.

Thank you!